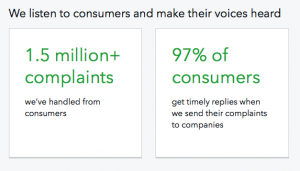

The CFPB captures consumer complaints providing a much higher visibility way for FI customers to get satisfaction. By its nature it 'encourages' bank follow up and resolution. They also make the contents of the complaint database available to search and analysis. The CFPB notes that each complaint can help many others:

How one complaint can help millions

By submitting a complaint, consumers can be heard by financial companies, get help with their own issues, and help others avoid similar ones. Every complaint provides insight into problems that people are experiencing, helping us identify inappropriate practices and allowing us to stop them before they become major issues. The result: better outcomes for consumers, and a better financial marketplace for everyone.

Somewhat surprisingly, at least to me, the National Association of Federally-Insured Credit Unions (NAFCU) has come out against making the data public. This position aligns with CFPB Acting Director Mulvaney's position. The CFPB notes that it does not verify the facts in the complaint beyond confirming that a relationship between the customer and the FI exists. But as noted above the information has real value to real people.

While one-off complaints may be of interest the bigger value is the patterns that the database can reveal. This can take two forms. First, common industry problems can be identified and acted on. Second, industry bad actors with multiple complaints can be readily identified.

The NAFCU's main complaint is that the complaints 'can have long-lasting effects on a credit union’s reputation, resulting in fewer members, market share, and potentially resulting in more time-consuming examinations.' Only complaints that are 'fully verified' should be made available. This, of course, would impose a significant burden on both the CFPB and each FI to provide the verification which would not be welcome by anyone. Especially given the volume of complaints.

What's odd is that the largest institutions likely have the most complaints. The vast majority of credit unions are small and probably have few if any complaints. So it's hard to know the real reason behind the NAFCU's position other than trying to curry favor with the head of the CFPB.